INCOME TAX RETURN LAST DAY:- EASY TRICK TO RETURN ONLINE EASILY.

e-file new 2 From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns. Read our Guide on how to link your PAN with Aadhaar. Step 1.Get started Login to your ClearTax account. Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’ Step 2.Enter personal info Enter your Name, PAN, DOB and Bank account details. Step 3.Enter salary details Fill in your salary, employee details (Name and TAN) and TDS. Step 4.Enter deduction details Enter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here. Step 5.Add details of taxes paid If you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS Step 6.E-file your return If you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen. Step 7: E-Verify Once your return is file E-Verify your income tax return Official website for e-filing Download full detail pdf file

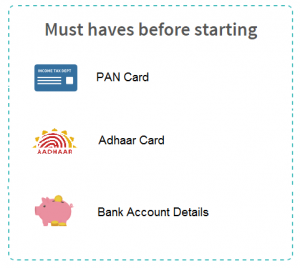

From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.

Read our Guide on how to link your PAN with Aadhaar.

- Step 1.Get started

Login to your ClearTax account.

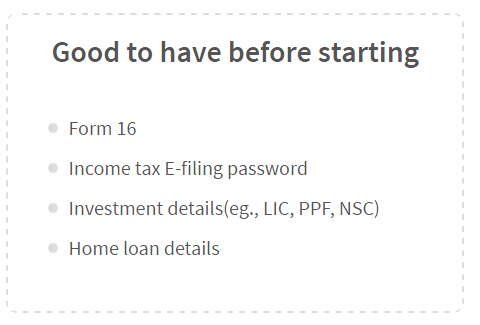

Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’

- Step 2.Enter personal info

Enter your Name, PAN, DOB and Bank account details.

- Step 3.Enter salary details

Fill in your salary, employee details (Name and TAN) and TDS.

- Step 4.Enter deduction details

Enter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.

- Step 5.Add details of taxes paid

If you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26AS

- Step 6.E-file your return

If you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.

- Step 7: E-Verify

Once your return is file E-Verify your income tax return

Official website for e-filing

Download full detail pdf file

No comments:

Post a Comment